WhatsApp, a messaging app that has become almost ubiquitous in everyday life, handles trillions of messages every year, all for free. For someone like me, who sends over 100 messages daily, this free service feels like a fundamental part of modern communication. However, it’s easy to forget that behind every simple message is an intricate and costly system designed to keep the app running. WhatsApp’s infrastructure, with data centers located worldwide, handles the encrypted messages of nearly three billion users—an immense operation that requires vast computational power and constant maintenance.

Despite its enormous user base, WhatsApp has never charged for personal use, a decision that seems counterintuitive given the costs of running such a large-scale service. However, WhatsApp’s profitability lies in its ability to generate revenue from businesses, not individual users. Since being acquired by Meta (formerly Facebook), WhatsApp has become a key asset in the company’s broader strategy to integrate communication and commerce.

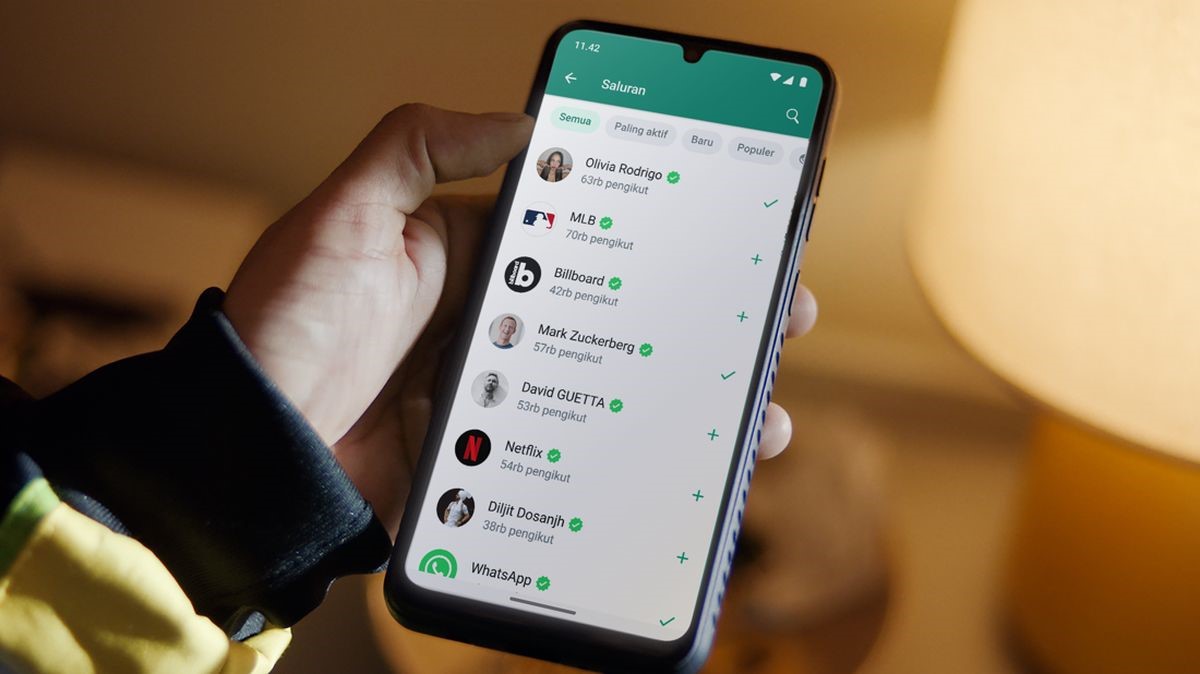

One of the main ways WhatsApp makes money is through its business platform, which allows companies to interact directly with their customers via the app. Businesses can set up public channels for free to broadcast messages to all who subscribe, but the real value lies in personalized communication. Companies are willing to pay for one-on-one interactions with their customers, using WhatsApp as a channel for customer service, transactions, and other engagements. This direct line of communication is highly valuable for businesses looking to build stronger relationships with their customers, and WhatsApp’s business tools have proven essential in facilitating these interactions.

The business use of WhatsApp has grown significantly, especially in markets like India. In cities such as Bangalore, users can now book bus tickets, choose their seats, and complete the entire transaction within a WhatsApp chat. This integration of commerce within a messaging platform illustrates WhatsApp’s broader goal of becoming a hub for both communication and transactions. Nikila Srinivasan, Meta’s Vice President of Business Messaging, has outlined a vision where users will be able to complete tasks such as making payments, booking flights, and returning purchases—all within a single chat thread. This streamlined experience reflects WhatsApp’s ambition to keep users within the app for both personal and business needs.

WhatsApp’s integration with Meta’s broader advertising ecosystem has also been a significant source of revenue. Businesses can now pay for advertisements on Facebook or Instagram that include a direct link to a WhatsApp chat. These ads offer a seamless transition from ad viewing to direct customer interaction, making the process more engaging and personal. This feature alone has contributed billions of dollars to Meta’s revenue, highlighting the growing importance of business-to-customer communication within the platform.

While WhatsApp has found immense success with its business model, other messaging platforms have explored different avenues for generating revenue. Signal, for instance, operates under a nonprofit structure. Known for its focus on privacy and encrypted messaging, Signal does not rely on corporate clients or ads to make money. Instead, the platform depends on donations from users and philanthropists. In 2018, one of WhatsApp’s co-founders, Brian Acton, donated $50 million to help sustain Signal’s operations. This model has allowed Signal to maintain its focus on user privacy, but it also means the platform’s financial future is less stable compared to revenue-driven competitors like WhatsApp.

Discord, a platform primarily used by gamers, has adopted a “freemium” model. While the basic service is free, users can purchase premium features such as enhanced video streaming and custom emojis. Discord also offers a subscription service, Nitro, which provides additional perks for $9.99 per month. This model has proven successful, allowing Discord to generate significant revenue while maintaining a free option for its user base.

Snapchat, owned by Snap Inc., has developed a hybrid revenue model that combines advertising, subscriptions, and hardware sales. With over $4 billion in annual ad revenue, Snapchat has positioned itself as a major player in the digital advertising space. The platform also offers a subscription service, sells augmented reality glasses, and has even profited from financial investments. Between 2016 and 2023, Snap earned nearly $300 million from interest alone, according to Forbes.

Element, a UK-based secure messaging platform, offers another alternative. Element caters to governments and large organizations, charging these clients to use the platform on their own private servers. This ensures that organizations maintain full control over their data, making Element an attractive option for those with high security requirements. Element’s co-founder, Matthew Hodgson, has reported that the company is nearing profitability, with revenues in the “double-digit millions.”

While the methods for generating revenue vary widely across messaging platforms, many rely on advertising to some extent. Even platforms like WhatsApp, which offer encryption and privacy protections, can collect data on user activity—such as who they communicate with and how frequently. This data, while anonymized, is valuable to advertisers who use it to create targeted marketing campaigns. By understanding user behavior, messaging platforms can offer advertisers a way to reach specific audiences without compromising user privacy.

In today’s digital landscape, the balance between offering free services and generating revenue has become a defining challenge for messaging platforms. WhatsApp has navigated this challenge by focusing on business messaging, allowing it to offer a free, encrypted service to individuals while charging companies for access to its vast user base.